Doctorate for researcher Ziad Al-Duba’i in Private Law from the Faculty of Sharia and Law at Sna’a University

- Categories Letters and Promotions - Graduate Studies, news, Regulations - Postgraduate Studies

- Date March 27, 2025

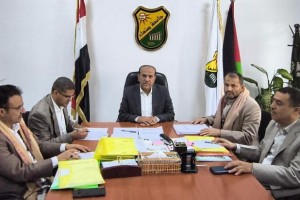

Ziad Abd Al-Salam Muhammad Al-Duba’i has earned a Doctorate in Private Law from the Faculty of Sharia and Law at Sana’a University for his thesis titled “The Legal Regulation of Insurance Companies and Brokers – A Comparative Study with Egyptian and Emirati Law” on Tuesday, Ramadan 25, 1446 AH, corresponding to March 25, 2025 AD.

The Viva discussion and judgment committee consisted of the following professors:

* Prof. Dr. Abdo Muhammad Saeed Al-Suwaidi (External Examiner – Police Academy) – Chairman.

* Prof. Dr. Abd Al-Rahman Abdullah Shamsan (Sana’a University) – Supervisor, Member.

* Assoc. Prof. Dr. Abd Al-Khaliq Saleh Abdullah Muazeb (Sana’a University) – Internal Examiner, Member.

The study aimed to identify the legal regulations of these companies in Yemeni legislation and compare them with Egyptian and Emirati legislation.

The study reveals a set of findings, the most important of which are:

* That the Yemeni legislator regulated the methods of organizing insurance and reinsurance companies and related professions, and worked to define the legal control frameworks for these companies.

* The current legislation does not meet the rapid economic development of this type of company, and does not lead to the creation of a stimulating work environment for both companies and their clients.

* Also, the Yemeni legislator did not regulate the governance methods of these companies, and how to develop their business and services digitally.

The study come out with a set of recommendations, the most important of which are:

* The Yemeni legislator should develop and update the regulatory legislation for insurance companies, brokers, and related professions.

* Regulate the provisions of digital transformation, methods and means of governance of insurance and reinsurance companies.

* Regulate the rules of Islamic insurance companies.

* Regulate the services of the insurance brokerage profession and restrict its practice to specialized commercial companies.

* Regulate the idea of compulsory and non-compulsory insurance pools, given their importance.

* Establish a specialized body to supervise and control insurance and reinsurance companies.

The Viva was attended by a number of academics, researchers, students, interested parties, the student’s colleagues, and family members.

Discover more from Sana'a University

Subscribe to get the latest posts sent to your email.

Next post