Master’s Degree Awarded to Ms. Kafaa Salem Mohammed in Economics

- Categories Letters and Promotions - Graduate Studies, news, Regulations - Postgraduate Studies

- Date February 5, 2026

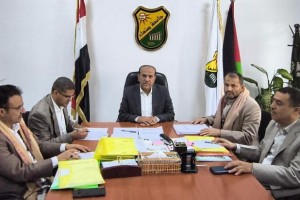

Ms. Kafaa Salem Haider Mohammed was awarded a Master’s Degree in Economics with an average of excellent and a grade of (93) for her thesis titled: The Impact of Asymmetric Information on the Automobile Insurance Industry in Yemen, which was submitted to the Faculty of Commerce and Economics – Sana’a University. The MA defense was held on Saturday, January 17, 2026.

The MA Viva-voce Committee, which was formed based on a resolution issued by the Graduate Studies and Scientific Research Council, consisted of the following:

# Committee Members Designation Position

1 Prof. Mohammed Yahya Yahya Al-Rafiq External Examiner Chair

2 Assoc. Prof. Salah Yassin Al-Maqtari Main Supervisor Member

3 Assoc. Prof. Ali Saif Kulaib Internal Examiner Member

The study aimed to investigate the impact of asymmetric information on the Automobile Insurance Industry in Yemen.

The study yielded several key findings summarized as follows:

Asymmetric information, in both its forms—adverse selection and moral hazard—has a negative impact on the Automobile Insurance Industry in Yemen.

The study demonstrated a strong, statistically significant positive relationship between the annual premium amount (as the dependent variable) and the amount of paid compensation, the number of insured vehicles, and the number of accidents, while the relationship with the value of vehicles involved in accidents was not statistically significant, as these were treated as independent variables.

The phenomenon of asymmetric information was found to be more pronounced in the individual motor insurance sector compared to group motor insurance

Based on these findings, the researcher recommended the following:

Undertaking comprehensive reform of the institutional and regulatory structure of the motor insurance market in Yemen by restructuring the supervisory and technical framework governing this market.

Strengthening disclosure requirements in individual insurance policies by obliging clients to provide accurate data on the nature of vehicle use, the number of drivers, and driving behavior, while encouraging group insurance through institutions and organizations to achieve better risk distribution.

The defense session was attended by a number of academics, researchers, students, colleagues, and the researcher’s family.

Discover more from Sana'a University

Subscribe to get the latest posts sent to your email.

Previous post

Sana'a University Graduate Studies Council Approves Updates to PhD Programs at Faculty of Languages

Next post